European markets are bracing for a hawkish stance from the European Central Bank (ECB) as the impact of unexpectedly high US inflation data influences investor sentiment. This development has tempered expectations for a significant rate cut from the Federal Reserve.

Following the release of US inflation data on Wednesday, European stock markets showcased mixed results as investors recalibrated their outlook on the Federal Reserve’s (Fed) interest rate trajectory, turning their attention to the ECB’s imminent rate announcement.

The Euro Stoxx 600 index closed flat after a day of fluctuations, while Germany’s DAX enjoyed a modest gain.

Against the backdrop of these developments, the euro faced downward pressure versus the US dollar, coinciding with a decline in major European government bond yields, contrasted by a modest uptick in US Treasury yields.

In the US, a tech surge propelled Wall Street’s rally, and the strengthening dollar indicated positive momentum. Following this activity, futures suggest a promising open for European markets today.

US Inflation Trends Show Mixed Signals

In August, US consumer prices increased by 2.5% year-on-year, down from July’s 2.9%, falling in line with market expectations and representing the lowest annual inflation rate since February 2021.

Nevertheless, core inflation—excluding food and energy—rose by 0.3%, surpassing the expected 0.2%, leading to a 3.2% annual increase, consistent with forecasts.

These figures have diminished the likelihood of a substantial 0.5% rate cut by the Federal Reserve during its policy meeting on September 17-18, with markets now pricing in a more likely quarter-point reduction instead.

According to the CME FedWatch Tool, the probability for a quarter-point rate cut has surged to 85%, significantly up from 50% in August.

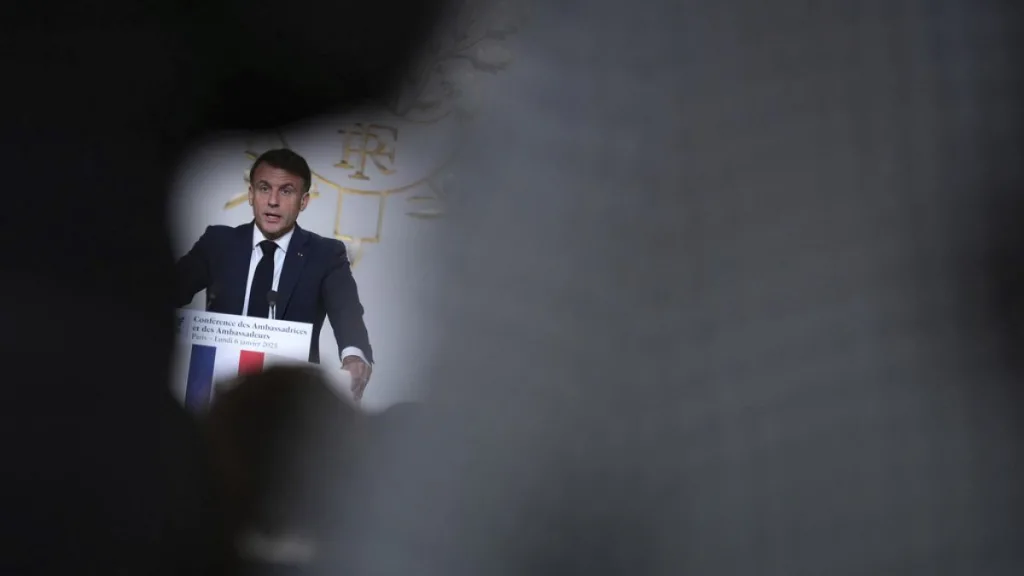

ECB’s Anticipated Cautious Rate Cut

Simultaneously, the European Central Bank (ECB) is anticipated to announce its second 0.25% rate cut this year in its forthcoming meeting.

However, the ECB is likely to adopt a careful tone concerning future rate adjustments, signaling potential inflation risks, particularly in light of the uptick in US core inflation.

Flash estimates reveal that Eurozone consumer prices grew at 2.2% in August, marking the slowest rate since July 2021.

Meanwhile, core inflation remains persistently at 2.8%. The sharp annual inflation decrease can be partially ascribed to a high base from the previous year.

Eurostat noted, “The slowdown was due to a steep decline in energy costs as base effects emerged in August.”

Impact on the Euro and European Markets

The reaction to US CPI data indicates cautious sentiment among investors regarding central banks’ future policy decisions.

Key European benchmarks have demonstrated relative stability this week, implying that prior optimism regarding significant interest rate cuts has lessened. Expectations now trend toward a more cautious approach from the ECB.

If the ECB signals slower-than-anticipated progress on rate cuts, further declines in European markets could be likely.

The EUR/USD pair recently reached a 13-month peak of nearly 1.12 in late August but retreated to about 1.10 in early Asian trading today.

The euro’s upward momentum against the dollar has waned in September, suggesting a more hawkish outlook from the Federal Reserve than previously thought.

This situation may lead to a weaker euro against the dollar as the month progresses.

Additionally, the British pound weakened following disappointing UK GDP data released Wednesday. The UK’s economy stagnated for the second consecutive month in July, which might compel the Bank of England to sustain its rate cuts for the remainder of the year.

Photo credit & article inspired by: Euronews